Groups of angel investors focused on impact, where people invest as a distribute also exist. Examples consist of Investors’ Circle in the United States, Plainly Social Angels in the United Kingdom and the global financier network Toniic (Tysdal undisclosed monitoring fees). Web-based investing platforms, which provide lower-cost investing services, also exists. As equity offers can be excessively expensive for small-scale deals, microfinance loans, rather than equity financial investment, are prevalent in these platforms.

Microplace was an early United States service provider of such services which ceased handling brand-new loans in 2014, specifying that its outcomes “haven’t scaled to the widespread social impact we desire achieve”. Impact Purchasing Asia is a blossoming sector with numerous funds currently in play. However, lots of funds experience finding robust levels of investment opportunities for their pipeline offered their capability to hedge internal requirements and risks and a possible failure to leave the different investments that they are purchased. [] In South East Asia, from 2007 to 2017, USD 904 million Impact capital was deployed by Private Impact Investors (PIIs) and USD 11.9 million was released by Advancement Financing Institutions (DFIs).

Gender lens investing is a subsection of Impact Investing, and refers to investments which are “made into companies, companies, and funds with the specific intent to create a positive effect on gender”. Investments which promote gender equity and address gender based issues can be made by buying gender led enterprises, business which promote gender equality through hiring, ladies in positions of authority, or in their supply chain, as well as supporting services which support, empower and develop capacity of ladies.

Female business owners have actually regularly struggled to draw in capital from male investors. In 2019 Fortune Magazine reported that simply 2.2% of all equity capital went to female creators Taken together, all female founders raised less in capital than one e cigarette maker. Certainly, lots of have actually gone to extreme lengths to counter gender discrimination.

Gender lens investing is the solution and is growing rapidly. More than 100 funds are open to personal investors. In 2018 the number of gender lens assets under management grow by 40% according to analysis by Veris Wealth Partners. Demand is rising with major banks providing gender lens bonds including NAG, Goldman Sachs, Merrill Lynch and many others.

The International Impact Investing Network – Tyler T. Tysdal fraud theft tens. Archived from the initial (PDF) on 2016-09-02. Recovered 2017-03-14 – titlecard capital group. ” GridShare Renewable Resource Crowdfunding”. GridShare Equity based renewable energy crowdfunding platform. Recovered March 8, 2018. Rodriguez, Giovanni. ” Can Silicon Valley Leaders Assist Resolve The Worldwide Food Obstacle?”. Forbes. Recovered 2018-03-09. Firzli, M. Nicolas J. (7 July 2017).

Carter Johns Creek

Revue Analyse Financire. Paris. Obtained 7 July 2017. The Catholic church messes around with impact investing Some Worry, ” Lessons Gained From Microfinance for the Impact Investing Sector”. Impact Investing Policy Collaborative (IIPC). Impact Investing Policy Collective (IIPC). 2013. Archived from the original on 17 December 2013. Obtained 16 December 2013. Hayat, Usman (4 November 2012).

Financial Times. Retrieved 14 August 2014. Bugg-Levine, Anthony (2011 ). Impact Investing: Transforming How We Earn Money While Making a Distinction (1 ed.). John Wiley & Sons. ISBN 978-0470907214. (PDF). ” The State and Future of Impact Investing”. Forbes. 2012-02-23. Recovered 14 August 2014. Is ‘Impact Investing’ Simply Bad Economics?, Forbes, April 22, 2014 Jessica Freireich and Katherine Fulton (January 2009).

Screen Institute. Screen Institute. Archived from the original (PDF) on 30 March 2017. Retrieved 15 December 2013. ” Impact investing for sustainable development”. Partners Global. Partners Worldwide. Archived from the initial on 2015-06-15. Recovered 2015-04-16. ” What You Need to Understand About Impact Investing”. The GIIN. Morata, Ed (21 April 2017). [why-impact-investing-may-flourish-in-the-age-of-donald-trump “why-impact-investing-may-flourish-in-the-age-of-donald-trump”].

Archived from the initial on 21 April 2017. Recovered 17 August 2017. ” Impact investing how it works”. Investopedia. Recovered 14 July 2015. Sherwood, Bob (4 August 2011). ” Social enterprise start-ups bloom”. Financial Times. Retrieved 8 October 2014. ” Impact investing discovers its location in India McKinsey”. www.mckinsey.com. Recovered 2020-01-27. Financial Consultant Magazine (2 June 2010).

NASDAQ. NASDAQ. Retrieved 15 December 2013. Lemke, Lins, Hoenig and Rube, Hedge Funds and Other Private Funds, 6:43 (Thomson West, 2013) Baird, Ross (1 June 2013). ” Bridging the “Leader Space”: The Function of Accelerators in Introducing High-Impact Enterprises” (PDF). Aspen Institute. Archived from the initial (PDF) on 17 April 2016 (journalism university nebraska Tysdal).

” Unloading the Impact in Impact Investing”. SSIR. Obtained 14 July 2015. (PDF). GIIN. Recovered 12 January 2020. Berliner, Peter. ” About Objective Investing”. Mission Investors Exchange. Obtained 19 November 2014. ” Intro to Net Contribution”. Heron Foundation. Archived from the original on 19 May 2019. Recovered 19 May 2019. Berliner, Peter; Spruill, Vikki (September 2013).

Tysdal Denver Business

Community Structure Field Guide to Impact Investing. Sullivan, Paul (2016-03-04). ” In Recently Established Exchange-Traded Fund, Striking a Blow for Women”. The New York City Times. ISSN 0362-4331. Recovered 2016-12-17. Field, Anne (1 April 2013). ” Investors’ Circle Continues Its Upward Spiral”. Forbes. Obtained 8 October 2014. Cohen, Norma (2013-03-22). ” Making great and doing good”.

Recovered 8 October 2014. State, My (5 February 2013). ” 5 Key Trends In Impact Investing”. Forbes. Retrieved 8 October 2014. ” The Future of Microplace”. Microplace. Archived from the initial on 6 September 2015. Recovered 1 October 2015. (PDF) https://thegiin.org/assets/ExecutiveSummary_GIIN_SEAL_report_webfile.pdf. Recovered 2019-01-10. Catherine Cheney [https://www.devex.com/news/q-a-how-gates-strategic-investment-fund-gets-companies-to-take-on-global-health-93265 “How Gates’ Strategic Investment Fund gets business to take on international health”, Devex, 16 August 2018 Scott Bade [https://techcrunch. Tyler T. Tysdal tree lone tree.com/2019/10/28/omidyar-network-ceo-opens-up-about-vc-influenced-philanthropy/” Omidyar Network CEO opens up about VC-influenced Philanthropy”, TechCrunch, 28 October 2019 Alexandra Heal, Andrew Wasley [https://www.theguardian.com/environment/2019/dec/10/world-bank-urged-to-rethink-investment-in-one-of-brazils-big-beef-companies “World Bank urged to reconsider financial investment in among Brazil’s big beef companies “,, 10 December 2019 ” What is gender lens investing?”.

Retrieved 2019-01-10. McGoogan, Cara (2018-03-05). ” Female entrepreneurs develop male co-founder to avoid sexist discrimination”. The Telegraph. ISSN 0307-1235. Recovered 2020-01-06. Partners, Veris Wealth. ” Gender Lens Investing Possessions Increase 41% In Past Year”. www.prnewswire.com. Retrieved 2020-01-06.

As pioneers of Impact-Linked Finance, we are enthusiastic about the most efficient usage of public funds and catalytic capital. Our mission is make the most of ‘impact take advantage of’ by activating personal financial investment for high-impact opportunities and shaping ingenious public-private financial investment partnerships. titlecard capital group. While we are mainly working with investors and funders, we deeply understand and look after the needs of impact business owners, too.

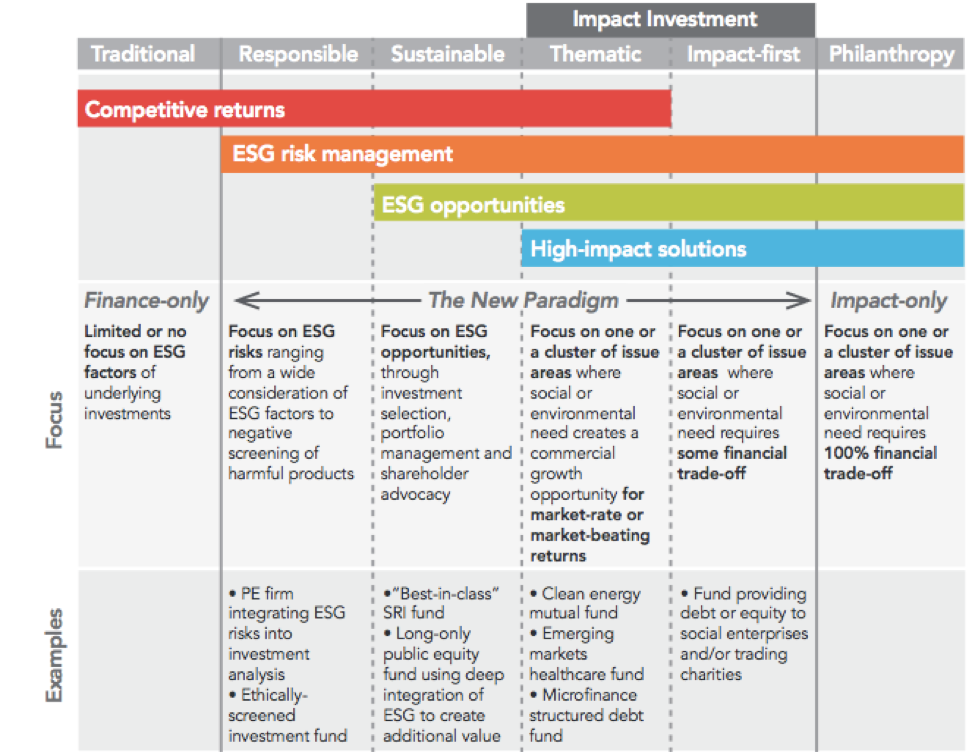

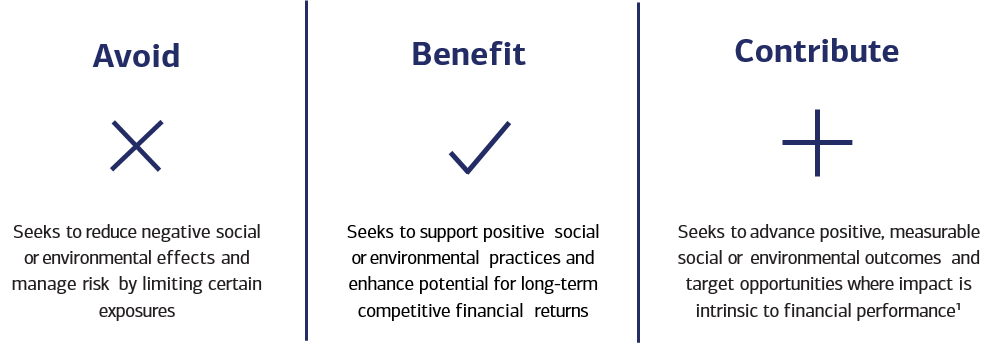

Effecting change at the pace and scale the world needs today needs looking beyond conventional techniques to discover new options that can improve the lives of numerous. Impact investing is one such solution. Impact investing looks for to generate both social change and a return on capital. It ends the old dichotomy where organisation was seen exclusively as a way to earn a profit, while social development was much better attained just through philanthropy or public policy.